Donate your vehicle to charity

Donating through Cars2Charities removes all the hassle of selling an old vehicle. It’s fast, easy, and free!

How does vehicle donation work?

Donating through Cars2Charities removes all the hassle of selling an old vehicle. It’s fast, easy, and free!

Three Simple Steps.

Call Us,

or Go Online

We Schedule

a Pickup

You Receive a Tax Deduction

Frequently Asked Questions

A car donation is a process by which a car, truck, van, or other type of vehicle is donated to a charity by an individual in exchange for a tax deduction.

The simplest explanation is that Cars2Charities picks up your vehicle, liquidates it by sending it to auction (or sells it via private party for maximum value), processes the sale through the Department of Motor Vehicles, and then sends the proceeds minus expenses to your favorite nonprofit organization. More on your tax deduction below!

Donating a car is the best way to get rid of an unused or unwanted vehicle. If your car is no longer running, has some body damage that is too expensive to fix, or perhaps doesn’t qualify for a trade-in, then donating your vehicle to charity is a great option for you! Of course, there are many other reasons to donate your old car, like supporting your favorite charity or just wanting to do something for your community. Maybe you just want the tax deduction! Donating your car to charity is a win-win for all involved whatever the reason.

You’ve probably noticed there are many charities competing for your car donation. Most actual charities are not able to process their own vehicle donations – so they hire a car donation servicing company, like Cars2Charities. So what should you look for in deciding where to donate your vehicle? (Since — whether you know it or not — 90% of the charities you love do use a service company.) Look for one that gets the highest value for your car. Our program does exactly that. We maximize the value of every donation we can. We’re also female and family-owned which is always a plus.

Your car donation is tax deductible! And the best part is, your vehicle donation helps contribute actual money to the charity you love. How, you ask? Simple. We sell all donated vehicles to create cash proceeds for the charities we represent. Once a donation sells, you receive a tax deduction receipt, and the charity gets the money raised by the sale of the vehicle, minus expenses. Everything is done in only a matter of weeks! Vehicle donations have never been easier, and if you have additional questions about how Cars2Charities vehicle donation program works, our friendly operators are here to guide you through the entire process!

Unfortunately, no. Cars2Charities does not give away or sell donations to the public. All of our donated vehicles are sent to auction or sold through pre-established, vetted partners ensuring anonymity and security through the proper legal channels. Our processes provide maximum value for our donors and charity affiliates without sacrificing any personal information or unsanctioned liabilities. Maybe try a local nonprofit that is better suited to help with your particular situation.

Charities that accept car donations...

Where Is the Best Place To Donate My Car For A Tax Deduction?

Giving a car as a charitable donation is a great way to fund your favorite charity. If you’re asking yourself, “If I donate a car is it tax deductible?” – the answer is “yes”. The IRS allows you to deduct the full amount of your sale price! Of course, the IRS also has important rules on charitable donations for vehicles. Many other organizations fail to make the best use of these rules to maximize the value of your tax deduction. For example, most charities or car donation organizations simply wholesale your vehicle — which usually gives you the lowest sales price, and as a result the smallest tax deduction for your car. This also means that the sale of your vehicle results in less money for your chosen charity. But there’s a better approach! Cars2Charities is leading the way with our unique operating model.

When you donate your car through Cars2Charities, we take care of all the paperwork and help you avoid possible issues that could arise in donating a car … so that you can simply enjoy the feeling of happiness you experience when you donate a car to charity. Knowing that those who donate cars are making a significant contribution to the causes they care about is a major motivator for others who want to do good in a similar way.

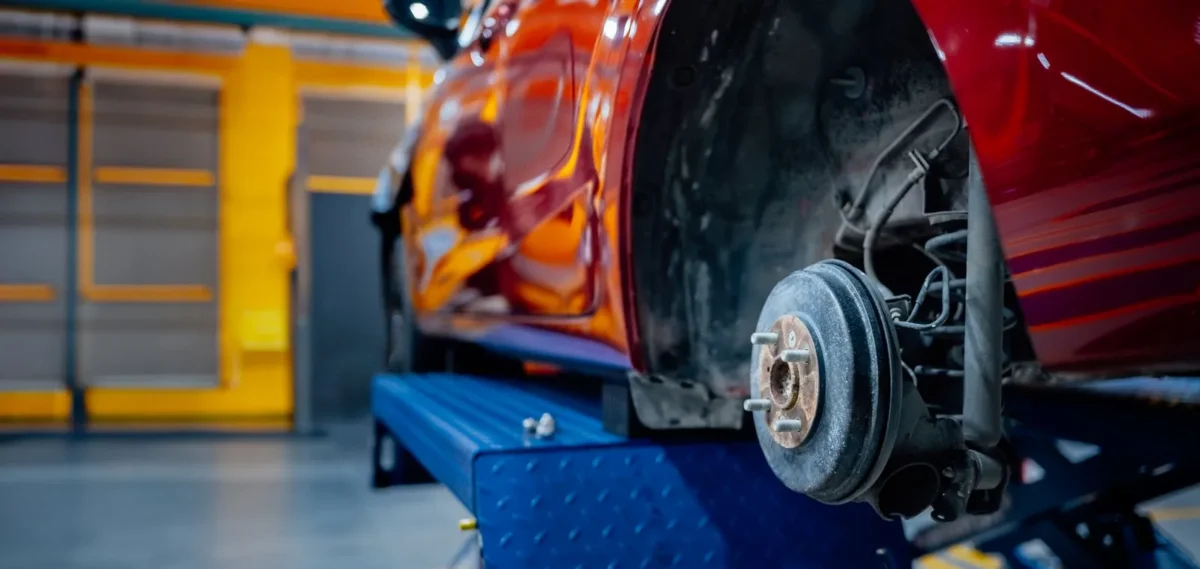

We accept all vehicle types, running or not.

We come to you.

If you have a vehicle you want to use as a charitable donation to a non-profit group, we help you donate your vehicle quickly and simply. We come to whatever location is most convenient for you – such as your home, business, mechanic shop – to pick up your vehicle . . . even if it’s not running.

We’re often asked, “Can I donate a vehicle with expired tags?” Yes. “Can I donate a vehicle without a title?” Yes. We can simply obtain a duplicate title for you at no cost. We answer most questions in our short, informative car donation video blogs. Or, just call if you’d like to chat.

What are our donors saying?

2000 Toyota Camry

Ronald McDonald House Southern California got more value

"Great experience, would work with them again."

Nick D., Car Donation - La Verne, CA

2003 Mazda Protege 5

Saddleback Valley Community Church got more value

"It was so easy to donate my car to Saddleback. I am very pleased."

Brian O., Car Donation - Mission Viejo, CA

2004 Saturn Ion

National Veterans Foundation got more value

"A 10. I thought this would go to the salvage yard. Impressed with the price."

Joe D., Car Donation - El Monte, CA

2005 Yamaha Golf Cart

Wounded Warrior Project got more value

"I was very satisfied with the service, and it was very fast, too."

Joseph, P., Golf Cart Donation - Tucson, AZ

2001 GMC Safari

Saddleback Valley Community Church got more value

"I've donated cars before but it hasn't always been this easy. I tried to sell this vehicle myself and had some bad experiences--so I went with Cars2Charities and they made it so easy and simple.

I'll probably go with C2C again."

Phillip S., Van Donation - Mission Viejo, CA

2004 Fleetwood

Make-A-Wish got more value

"See my Yelp Review. Great to work with, everything just as promised. Went to a family with small kids :)"

Michael W., Trailer Donation - San Jose, CA

1998 Honda Civic LX

UCSD got more value

"I'm very glad that they were able to take this car off my hands quickly,

getting me a nice tax deduction while I can support a charity."

Lindsey E., Car Donation - Poway, CA

1999 BMW 325

St. Andrews Presbyterian Church got more value

"It was a spare car, we just wanted to stop collecting dust and make a difference."

Jeff Z., Car Donation - Newport Beach, CA

1993 SeaRay Jet Boat

Humane Society got more value

"Excellent! I'm so pleased the boat found a new home."

Sheri C., Boat Donation - Mission Viejo, CA

2004 Golf Car

Wounded Warrior Project got more value

"If there was a survey I'd give Cars2Charities a 10!"

Glenn, H., Golf Car Donation - Kingman, AZ